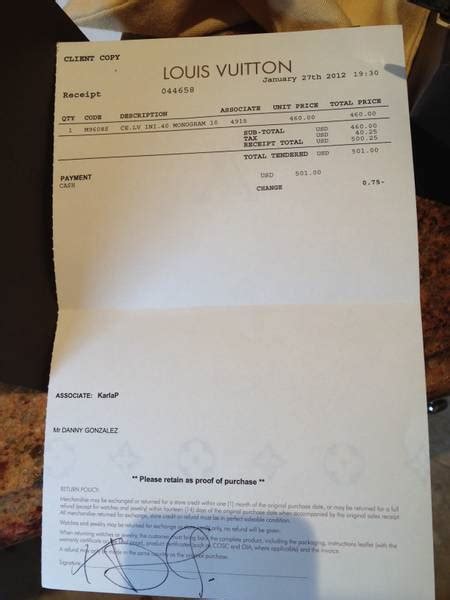

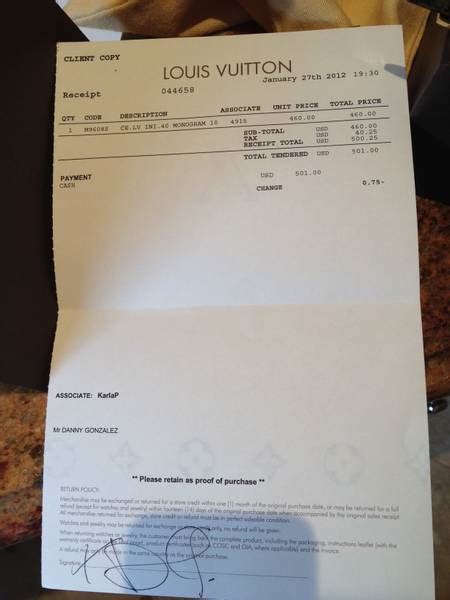

where to buy louis vuitton tax free | louis vuitton sales tax avoidance where to buy louis vuitton tax free At the Store: Present your passport and ask for the sales invoice and tax-free forms from the staff at eligible stores. At the Departure Airport: . 1968 Omega Speedmaster Reference 145.012-67 SP - HODINKEE Shop. Why This Watch Matters The Omega Speedmaster ref. 145.012-67 SP was the last of its model to be fitted with the famous caliber 321 movement, and this example has a beautifully aged patina gained over the last 50 years.The origins of the Oyster Perpetual can be traced back to 1926, when Rolex unveiled the first waterproof and dustproof wristwatch. This groundbreaking model was dubbed the “Oyster” after the watertight mollusk shell that inspired its case design. Just five years later in 1931, Rolex introduced another . See more

0 · louis vuitton tax free shopping

1 · louis vuitton sales tax exemption

2 · louis vuitton sales tax avoidance

3 · louis vuitton no sales tax

4 · louis vuitton handbags cheap

5 · louis vuitton duty free shop

6 · does louis vuitton pay taxes

7 · cheapest country to buy louis vuitton

$3,700.00

In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to . At the Store: Present your passport and ask for the sales invoice and tax-free forms from the staff at eligible stores. At the Departure Airport: . One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on . If you’re looking to purchase a Louis Vuitton product at a more affordable price, it’s worth researching prices across different countries and considering factors like taxes and .

Louis Vuitton offers VAT refund everywhere in Europe. To get it, follow these simple steps. When you're at Louis Vuitton's checkout with your dream bag, tell the Sales Assistant that you would like to get a VAT refund. The Pros of Buying Louis Vuitton at the Airport. Tax-Free Shopping. If you are traveling internationally, you can take advantage of tax-free shopping at many airports. This .

But what country offers the absolute best tax-refund for Louis Vuitton bags? We’re going to help make it easy for you with our handy table, which provides all information on VAT .Guide to shopping Chanel, Louis Vuitton, Celine, Dior, Hermes and other brands tax-free at airports. Below is a price comparison between purchasing a designer bag in a Euro country versus the US (New York for example). Since the cost savings are much larger people should . In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to luxury .

Hong Kong is home to some of the biggest luxury stores, and you will be happy to know that the Louis Vuitton bags sold there are slightly low-priced. Hong Kong is a tax-free country, and though there might be some changes in this, you will be happy with the great discount offerings from the country. 4. At the Store: Present your passport and ask for the sales invoice and tax-free forms from the staff at eligible stores. At the Departure Airport: Take your passport, refund forms, receipts and purchases to a customs official for verification. One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on international waters, and they offer tax-free shopping to travelers. If you’re looking to purchase a Louis Vuitton product at a more affordable price, it’s worth researching prices across different countries and considering factors like taxes and exchange rates. While Japan is often cited as the cheapest option, there may be other countries that offer competitive pricing as well.

Louis Vuitton offers VAT refund everywhere in Europe. To get it, follow these simple steps. When you're at Louis Vuitton's checkout with your dream bag, tell the Sales Assistant that you would like to get a VAT refund.

louis vuitton tax free shopping

louis vuitton sales tax exemption

The Pros of Buying Louis Vuitton at the Airport. Tax-Free Shopping. If you are traveling internationally, you can take advantage of tax-free shopping at many airports. This means that you can save up to 20% on your purchase. But what country offers the absolute best tax-refund for Louis Vuitton bags? We’re going to help make it easy for you with our handy table, which provides all information on VAT percentage amounts for several countries, along with the VAT amount you’ll receive after paying administration fees.

Guide to shopping Chanel, Louis Vuitton, Celine, Dior, Hermes and other brands tax-free at airports.

Below is a price comparison between purchasing a designer bag in a Euro country versus the US (New York for example). Since the cost savings are much larger people should take advantage while you still can. The savings for a Chanel Jumbo is almost 28% percent off, see comparison below. In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to luxury . Hong Kong is home to some of the biggest luxury stores, and you will be happy to know that the Louis Vuitton bags sold there are slightly low-priced. Hong Kong is a tax-free country, and though there might be some changes in this, you will be happy with the great discount offerings from the country. 4.

At the Store: Present your passport and ask for the sales invoice and tax-free forms from the staff at eligible stores. At the Departure Airport: Take your passport, refund forms, receipts and purchases to a customs official for verification. One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on international waters, and they offer tax-free shopping to travelers. If you’re looking to purchase a Louis Vuitton product at a more affordable price, it’s worth researching prices across different countries and considering factors like taxes and exchange rates. While Japan is often cited as the cheapest option, there may be other countries that offer competitive pricing as well.

Louis Vuitton offers VAT refund everywhere in Europe. To get it, follow these simple steps. When you're at Louis Vuitton's checkout with your dream bag, tell the Sales Assistant that you would like to get a VAT refund. The Pros of Buying Louis Vuitton at the Airport. Tax-Free Shopping. If you are traveling internationally, you can take advantage of tax-free shopping at many airports. This means that you can save up to 20% on your purchase. But what country offers the absolute best tax-refund for Louis Vuitton bags? We’re going to help make it easy for you with our handy table, which provides all information on VAT percentage amounts for several countries, along with the VAT amount you’ll receive after paying administration fees.

Guide to shopping Chanel, Louis Vuitton, Celine, Dior, Hermes and other brands tax-free at airports.

louis vuitton sales tax avoidance

montre versace femme reve

As you can see in the pictures, the bezel is the black “Base 1000” version. This is quite rare and was only in use for a few years. The dial used tritium for luminous material, but in those days, it wasn’t mandatory to indicate this with Ts around “Swiss Made”. This . See more

where to buy louis vuitton tax free|louis vuitton sales tax avoidance